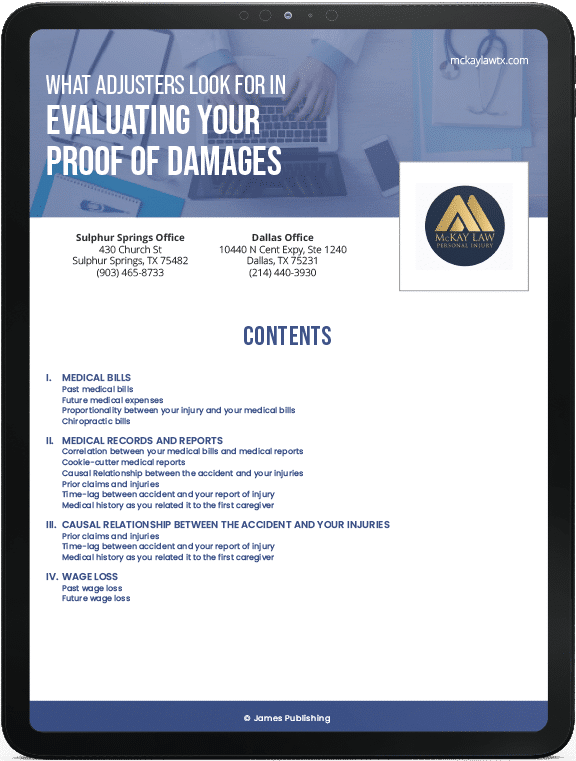

You must present proof of your injuries and the losses they have caused in order to obtain compensation for the harm done to you. In analyzing your proof, the adjuster will consider the following factors:

Download The eBook Instantly

Get these useful resources from McKay Law on the go. Leave us your email and we will instantly send out the download link.

I. MEDICAL BILLS PAST MEDICAL BILLS

All other things being equal, the higher your medical bills, the more your case is worth. If a settlement demand includes charges for which you don’t have the supporting documentation, an adjuster may wonder what other areas of your claim are soft, suspect or padded.

When you provide the adjuster with a breakdown of your medical expenses in your demand letter, you must also provide a copy of each bill with your supporting documentation. If a bill is referenced, but no such bill is produced, the adjuster will not give that expense much weight or credence.

FUTURE MEDICAL EXPENSES

For some injuries, future treatments are foreseeable. You should get a doctor’s opinion to this effect and a cost estimate to include in the materials sent with your demand letter.

PROPORTIONALITY BETWEEN YOUR INJURY AND YOUR MEDICAL BILLS

One prime aspect that insurance adjusters look for in any claim is a sense of proportionality between the injuries claimed and the extent of the medical bills incurred. Adjusters develop a “sixth sense” as to when the medical bills are out of alignment with the nature and severity of the injury.

Soft tissue injury claims, in particular, are prime candidates for “build up,” a term of art among adjusters meaning to artificially inflate the amount of medical bills incurred, in order to increase the perceived settlement value of the claim. Adjusters will balk at paying if they believe that the medicals have been “goosed up” or that you were steered to a medical treatment “mill” to inflate the bills.

The best way to avoid raising this suspicion is to find a treating doctor on your own, rather than seeking a referral from a personal injury lawyer.

If you are treating with your primary care doctor, who is probably not a specialist, request a referral to a board-certified specialist who can confirm that you are receiving proper treatment and recommend future care as well. A report from a board-certified medical doctor showing that the amount of treatment you received was medically necessary and appropriate can allay the adjuster’s suspicions.

CHIROPRACTIC BILLS

There is no question that adjusters are less impressed by chiropractic doctors than by board-certified orthopedic surgeons. Once you have received a minimal amount of chiropractic treatment, it’s a good idea for you to see a board-certified medical doctor to confirm the amount of treatment, the appropriateness of the charges to that point, and their necessity.

II. MEDICAL RECORDS AND REPORTS CORRELATION BETWEEN YOUR MEDICAL BILLS AND MEDICAL REPORTS

Adjusters become suspicious when a claimant’s medical bills are not supported by corresponding medical reports. The reports validate the diagnosis made, treatment given, and future prognosis. If you do not include a medical report for each bill, the adjuster may discount—or even disregard—those particular charges.

In medical malpractice litigation, it is often said, “If it’s not in the chart, it didn’t happen.” Some claims adjusters take the same approach to evaluating medical expenses: If there is not a medical report to go along with the bill, it isn’t worthy of consideration.

COOKIE-CUTTER MEDICAL REPORTS

Fill-in-the-blank medical reports will garner an adjuster’s skepticism. This is a problem since many doctors who specialize in treating patients who have been in accidents often will produce the same reports time after time, with only slight variations. For example, if three people in the family are involved in a car accident, the doctor’s reports may be identical, but for the name at the top of each form. Ask your doctor to prepare a customized report.

It is not uncommon for adjusters to see medical reports from the same healthcare providers over and over again, and to form opinions about these doctors and their medical practices. When a claim is presented with one of “those doctors” as the treating physician, it is likely to raise a red flag in the adjuster’s mind.

III. CAUSAL RELATIONSHIP BETWEEN THE ACCIDENT AND YOUR INJURIES PRIOR CLAIMS AND INJURIES

The adjuster will closely examine your medical records for any evidence that your injuries may have been caused by something other than the accident. The adjuster is looking for:

- Notations of prior claims or injuries;

- Mention of pre-existing conditions or injuries to the same body part;

Any mention of intoxication, alcohol or drugs; and

- References to the accident or injury history that deviate from the “official” account of the accident that has been presented to the adjuster.If you have a history of prior claims, do not expect a quick settlement. In fact, the insurer may suspect it is dealing with a “professional claimant” and arrange surveillance on you or even refer the file to its “Special Investigation Unit,” which investigates fraud. One of the best ways to minimize this problem is to establish – clearly and boldly, right up front – that any prior injuries or claims concerned completely different areas of your body (assuming, of course, that this is true).

TIME-LAG BETWEEN ACCIDENT AND YOUR REPORT OF INJURY

The longer the time-lag between an accident and the time you report an injury to a doctor, the higher the skepticism with which the adjuster will view the claim. If you did not seek immediate treatment, you will need to explain why.

MEDICAL HISTORY AS YOU RELATED IT TO THE FIRST CAREGIVER

The adjuster will closely scrutinize the medical records from your first caregiver (e.g., the emergency room physician), focusing on the explanation you gave for your injury. If the records say nothing about an accident or attribute your injury to a pre-existing condition, expect adjuster resistance.

IV. WAGE LOSS PAST WAGE LOSS

How much time did you lose from work due to the injury? Can you prove your claim of lost wages with the following:

- A written report from a doctor stating that you were disabled for a specified length of time; and

- A statement from your employer, verifying your hourly wage or salary and your absence from work for the time the period during which the doctor stated you were unable to work.

- If you do not have these documents, expect the adjuster to refuse to factor wage loss into your damages, especially if your claimed lost earnings are a high proportion of your total economic losses, or if the length of your disability seems unusually long, given “normal” recovery times for comparable injuries.

FUTURE WAGE LOSS

Aside from the time you have already lost from work, your injury may cause you to lose wages in the future. Future wage loss might include: diminished earnings from a permanent disability, hospitalizations for future surgeries, and time off for continued physical therapy and medical treatment. To convince the adjuster that these losses are legitimate, you will need to get a written medical opinion documenting your permanent disability and probable need for future care.